Recent studies by Linked IN show Sales people who embrace Social and Digital Marketing channels to connect with customers outperform their peers by 200% on LinkedIN.

IN show Sales people who embrace Social and Digital Marketing channels to connect with customers outperform their peers by 200% on LinkedIN.

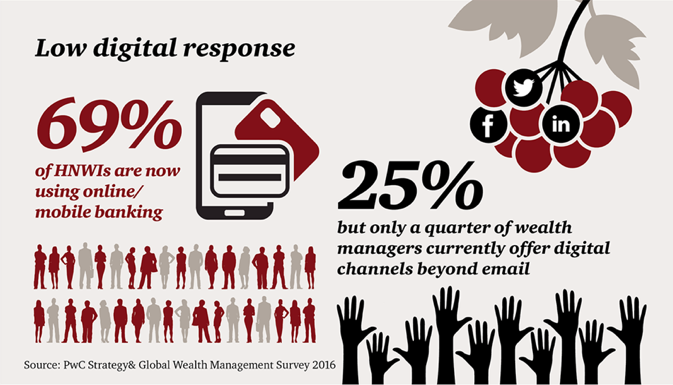

According to recent study by PWC in July 2016, “Sink or Swim. Why Wealth Management can’t afford to miss the digital wave”, wealth management is one of the last industries to realize potential business impact of using digital to connect sales people with today’s customers. The study shows 69% of attractive high net worth customers are sophisticated digital natives, but only 25% of the Wealth Managers leverage the opportunity. Recently Wealth Management companies have woken up to the opportunity and accelerated hiring of new talent, sourcing new technology and collaborating with innovative start-ups.

I joined Manulife / John Hancock 3 years ago to help close that gap. Coming from Microsoft and the technology industry, the challenge was to prove digital marketing best practices could also work in Financial Services. We built a terrific team of experts and began a mission to educate, win over naysayers, then scale-out industry best practices. As results started to pile up, the initial resistance turned to support, enabling us to build a world class program recognized inside and outside the company. I’m particularly proud to have illustrated the impact of socially active Financial Advisors & Executives on the business, winning the company’s 1st Social Media award, and receiving praise by LinkedIN for being company with highest metrics on their Elevate employee activation product.

Along the road we learned a few valuable lessons on digital marketing in FinServ.

- Biggest short term WIN is getting Wealth Managers using social networks to sell (#SocialSelling)

- Advisors WANT to use digital / social channel to grow business, and WANT help from Marketing

- Risk & Regulation is NOT a show stopper (instead something you will manage)

- Results are AMPLIFIED by leap frogging competitors (opportunity to use as differentiator)

- Need senior ADVOCATES helping finding ways to enable digital VS reasons not to

Clearly the biggest short-term opportunity for most Financial Service firms is digital activation of their Wealth Managers. Financial Services is built on personal connections between customers & Wealth Managers where being trustworthy, responsive and on top of what’s happening is vital. An effective digital program enables Wealth Managers / Financial Advisors to more effectively deliver a customer experience which helps acquire leads, build relationships, monitor buying signals and close more business faster.

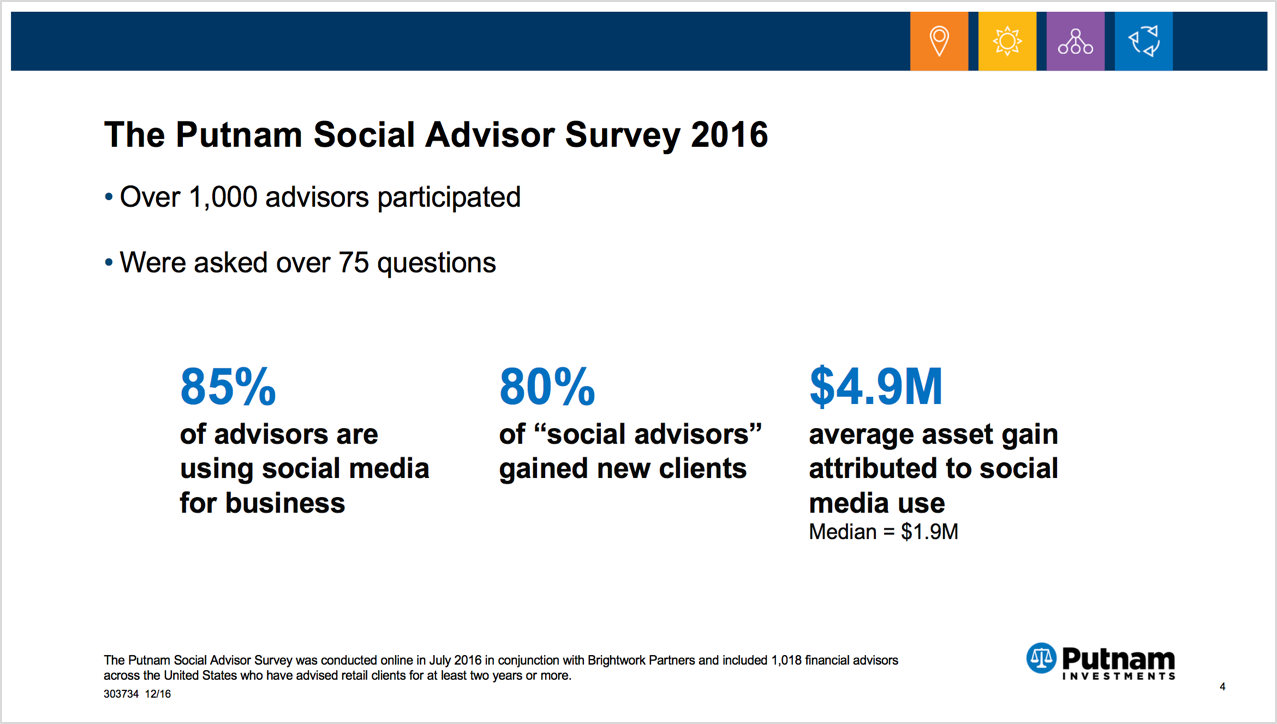

In December 2016, Putnam Investments shared a study of business impact driven by Digitally Savvy Wealth Managers in their organization. 85% of the 1000 advisors in study are active on social in 2016, with 80% of those indicating they’d attracted new clients from social averaging $4.9M in assets. I’d say that’s crossing the chasm.

Wealth Managers WANT to use digital marketing channel to grow business but NEED Marketing to help.

Similar to the saying…”it takes a village to raise a child”…it also takes collaboration from Sales & Marketing to deliver digital impact for Wealth Managers & other sales folks.

The reason is customer expectation. The expectation of a modern digital customer experience is set by the common services & brands we all deal with everyday. How fast and easy Google is to use, how robust and efficient Amazon is, how beautiful and intuitive Apple / iTunes is, how much we love that content on Netflix. Each of these deliver users a clear “value to me” with every interaction. They inform, teach, entertain or help accomplish a desired task.

For Wealth Managers in Canada the new law around transparency into fees (known as CRM2) further amplifies the need to deliver clear value beyond transactions. Advisors I’ve spoken to are nervous about these discussions with clients, and eager to find new ways to deliver value for their fees. They are interested in opportunities to share timely information via blogs and social channels, listen to activity so they can be proactive with recommendations, and provide more choices to clients on how they would like to communicate (text, video chats…).

Delivering value everyday requires commitment and a programmatic approach. We are competing for customer / prospect’s time in crowded market, so we need to deliver value to get our share of attention. The competition is not the other FinServ companies, it’s the world class brands & start-ups that deliver the desired content, services and products easily. To be successful in this, brands need to partner with Sales teams on the ongoing program. Both sides will need to invest time to understand what customers want and the most efficient way to deliver it.

People want to buy from people, not faceless companies.

Modern customers are different. They expect to connect and converse with a live person in timely manner in whatever way they want (email / text / phone). Studies have shown providing more access & touch points with your people increases trust, comfort and likeliness to buy. This insight is what’s driving companies to accelerate digital activation of Sales and other public facing employees.

So the question becomes how can you efficiently activate your people quickly? I recommend a 2 step approach.

Activation Step 1 = Company must Embrace, Enable & Activate the Digitally Savvy Advisor

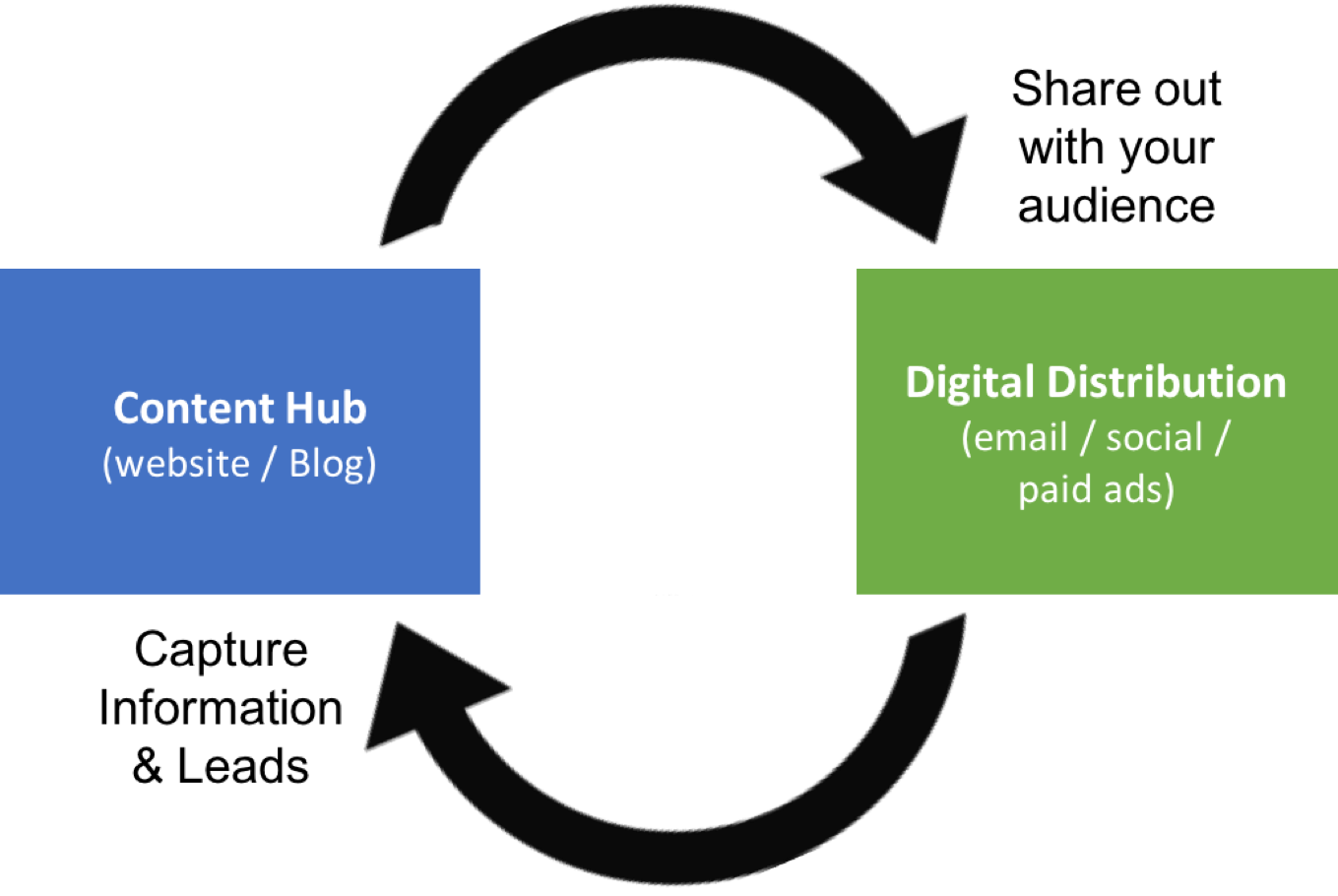

The first step to increase access for your people i s getting the right digital marketing channels set up for each of your Wealth Managers. Best practices say this should include a website (or at least a page on company site), a blog, opt-in email program, LinkedIN profile, Twitter, & Facebook for business page.

s getting the right digital marketing channels set up for each of your Wealth Managers. Best practices say this should include a website (or at least a page on company site), a blog, opt-in email program, LinkedIN profile, Twitter, & Facebook for business page.

A modern digital presence is an ongoing cycle of publishing high value content to your website/blog, then using your email / social to share the content out to your audience driving them back to your website. Once on your website you can track their activity / interests, and ultimately convert them from lead to sale. More information on Modern Digital Marketing Cycle can be found in a previous post.

To get the channels set-up for each Wealth Manager you’ll likely have to complete these tasks:

- DEFINE the Governance to satisfy Risk & Regulatory (this already exists in the industry)

- SOURCE technology to manage Governance process (archiving, publishing, monitoring)

- TRAIN Sales participants (material from vendors / experts in industry)

- PROVIDE profile writing support (one time task, vendors / freelancers can help here)

- MONITOR Monitor performance & coach (share best practices on “Social Selling” & Conversational Commerce)

Once you have digital channels setup for each Wealth Manager, you will likely notice a little challenge. A personal digital channel is like owning a newspaper or TV station. Each Sales person needs to provide an ongoing stream of content to keep the audience engaged and growing. When you stop publishing your audience will wander off to other things, losing the investment you have made to build that audience.

This where Sales really needs Marketing to help…and we can move on to the 2nd step.

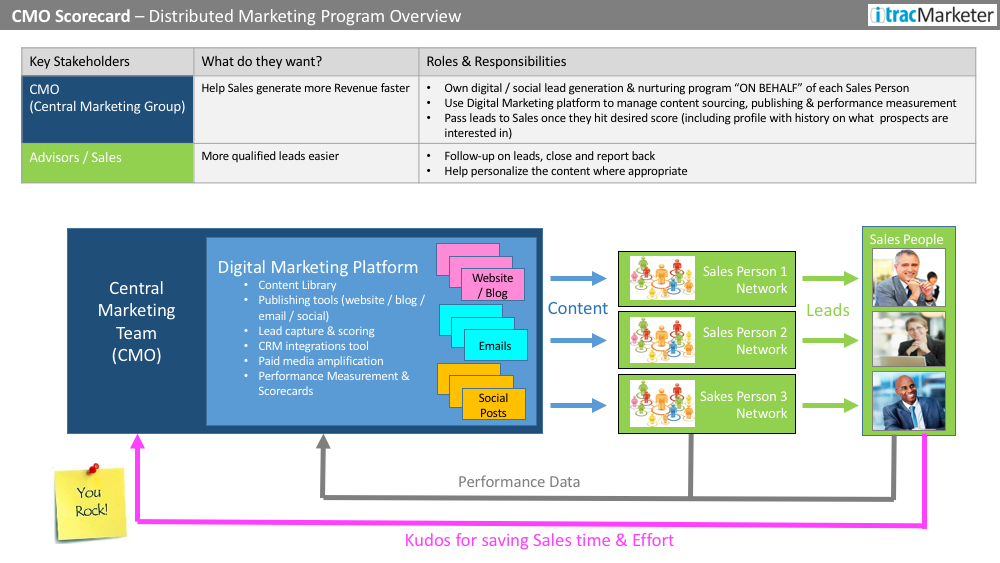

Activation Step 2: Marketing manages program “on-behalf” of each Sales person

Sales people have seen the data, they know they need to embrace digital. They know they need to be more active on digital channels, some even understand how to do it, but most don’t have the time to do it properly.

Company leaders also know they need to help. A recent paper by McKinsey shows helping digitally enable a B2B Sales team delivers 5x performance vs peers.

Marketing in particular has the opportunity to jump in and really help Sales here. As we noted in previous post “Marketing “On-Behalf” of Sales. New opportunity for modern CMOs”, it’s unrealistic to expect Sales people to build & maintain a world class personal brand experience across all their digital channels on their own. As Sales people, Wealth Managers should be out selling not worrying about delivering high value content on blogs, emails and social channels everyday.

Modern technology makes it possible to deliver this Sales / Marketing WIN-WIN using a concept we call “Marketing on-behalf of Sales”. Using the ItracMarketer Distributed Marketing Platform, we enable central Marketing teams to manage lead capture & nurture activities “on-behalf” of each individual sales person using each of their own personal digital marketing channels (website / email / social). By centralizing this program, the Marketing team is able drive results across the enterprise, while scaling the # of Sales people supported without increasing costs.

We would welcome any feedback or an opportunity to discuss and share examples. Our contact info can be found here.

_________________________________________

Brendan Kenalty is one of the founders of itracMarketer and a digital marketing pioneer. An award winning Digital & Social Marketing leader with +20 years experience driving transformation, innovation & revenue impact across broad range of industries, startups & global brands, Brendan is currently our Chief Marketing Officer.

Brendan Kenalty is one of the founders of itracMarketer and a digital marketing pioneer. An award winning Digital & Social Marketing leader with +20 years experience driving transformation, innovation & revenue impact across broad range of industries, startups & global brands, Brendan is currently our Chief Marketing Officer.

Leave A Comment